Why Are so Many Companies Still so Disjointed?

AUTHOR:

Christian Babbini, FCPA, FCMA

Founder and Vice President, Strategy

Dominic Bélanger, CPA CMA

Consultant

Everyone agrees that the various departments within a company or organization should communicate well and be fully integrated with each other. However, the fact remains that, even today, many of them are still working in silos.

For decades now, organizations have been hearing about the concept of aligning operations with strategic orientations. So, why are so many of our actions and decisions still so disjointed?

There are many possible answers to that question, some of which are:

- Poorly calculated costs

- Lack of profitability

- Lack of funds

- Lost sales

- Budget not aligned with operations

- Capacity issues

- Outdated operations

- Inefficient supply chain integration

- Outdated information systems

- Inefficient resource management

- Contribution margin poorly understood (per unit or per hour?)

- Ineffective management of rebates and discounts

- Information quality questioned

- Inability to obtain timely information

- Poor communication

In this first article, we will discuss the delicate balance between sales and operations. Operations are the beating heart of an organization; this generates a certain amount of stress, as they must be able to produce the goods that Sales needs. But, Sales are also under pressure because they need to achieve quarterly sales targets. And, Finance is somehow trying to produce information for all these people and, in many cases, meet unrealistic deadlines. The end result is utter chaos!

But, does it really have to be that way? If we review the steps involved, the process seems relatively simple:

- Create a business strategy

- Align sales with this strategy

- Operations do as they are asked

- Finance produces financial statements

Strangely enough, the planning between sales and operations is not that simple. The organization’s top executives make projections with an eye to achieving the desired financial results. These form the basis of a budget. Next, it’s Operations' turn to pick up the ball and deliver the goods. Sales and Operations Planning (S&OP), as this is often referred to, basically consists of aligning daily production with the monthly schedule laid out in the budget. Far from being straightforward, just as there are in sports, there are unforeseen circumstances at every turn: injured players, poorly executed plays, coaching changes, player trades, new rules, etc.

The first question to ask yourself is: does the sales budget make sense in relation to operations? If sales do not take operational realities and constraints into account, it will be difficult to achieve the desired targets. Not to mention the fact that, as in sports, the surprises just keep on coming.

Like hockey, you have to play both ends of the ice and remember your wingers. Here are four things to keep in mind:

- North-South Approach – Integrate demand and resources;

- East-West Approach – Work with your wingers: IT, HR and all the other departments;

- Put your best players on the ice – Be sure to maximize your overall return. To achieve this, you must set a fair cost and maximize your production mix based on your products’ actual profitability and available capacity;

- Finally, be flexible – Don’t panic! Think about new demands and adapt your strategy accordingly.

How It Works

The relevant variables are as follows: production data (machine capacities, product speeds, rejection percentages, set-up times, etc.); cost data (unit costs, contribution margins – per unit or per hour, depending on your operations – transparency, and a thorough grasp of cost behaviour); and sales forecast data (volume, prices, discounts, etc.). Once all the variables are in place, you’re ready to implement the S&OP process.

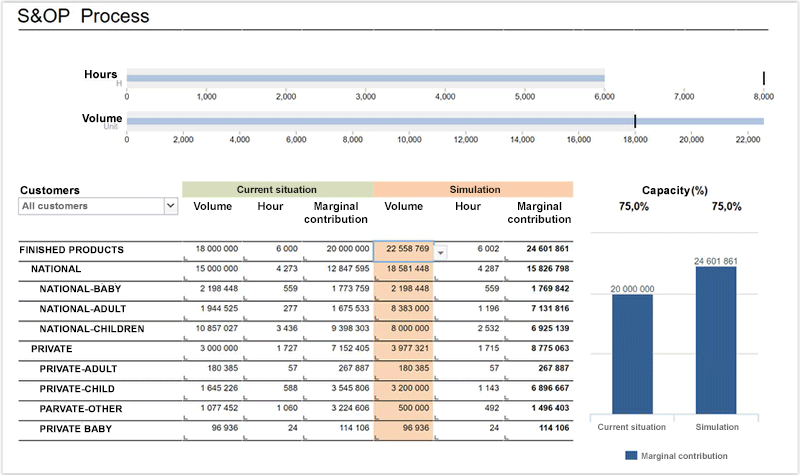

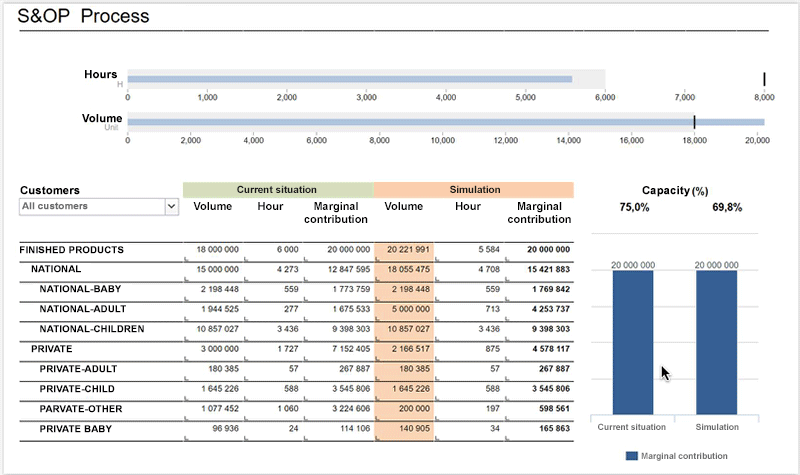

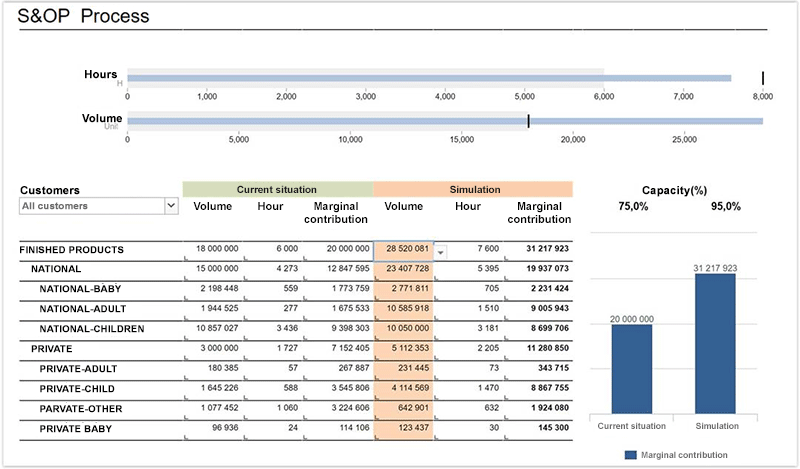

The following examples show how Finance can help maximize profitability by bringing sales in line with operations.

Example 1 shows that the organization’s overall contribution margin would increase by more than 12% – without any increase in resource use – if it maximized its production mix according to certain aforementioned operational and financial criteria. Using the same 6,000 production hours as are currently being used, the organization can produce more volume and achieve a higher contribution margin.

Example 2 shows how it is possible to free up production capacity in order to reduce expenses, thereby producing the same output with fewer resources. One possible avoidable expense is overtime. You could avoid paying overtime hours, or having to add an extra shift by focusing on value-added products.

Example 3 shows how the organization could increase its overall contribution margin by simultaneously maximizing both its production mix and its capacity. A great way to justify any new investments you might have made!

In conclusion, the right tools will help you achieve the desired results! Equipped with accurate financial and operational data and the relevant tools, your organization will be able to better predict the financial impact of different scenarios. Furthermore, when costs and operations are transparent and well understood, it will be easier to interpret and explain monthly variances.

While all of the above involves a certain amount of work upstream work, the ROI is amazing!