How good is your Budgeting Process?

Sébastien Boivin CPA, CMA

Director, DECIMAL

In a context where the finance function has to produce more with ever more tightly controlled resources, it makes sense to look for ways to optimize time-consuming, non-value added activities. When applied to budgeting, this means CPAs spend less time on transactional activities, and take on a more analytical role, to maximize the added value they bring to the organization.

According to a McKinsey Global Institute1 study on transforming the digital finance function, 56% of financial planning and analysis (FP&A) activities can be either fully (11%) or mostly (45%) automated. To successfully achieve their digital transformation, CFOs must prioritize delivering near real-time financial information to end-users, accelerate decision support, and uncover hidden growth and cost-saving opportunities for shareholders.

An analysis of organizations' traditional budgeting processes shows that, in most cases, the objectives of digitally transforming the finance function are not met. It's no secret that budgeting tends to generate a lot of clerical work, provides little timely information to end-users, delays decision-making due to manual consolidation processes, and reduces the ability of key resource people to look over the budget data for operational efficiencies and growth opportunities.

To bring this into the real world, let’s take a look at the various stages of the budgeting process and find ways to optimize yours.

BEFORE WE START …

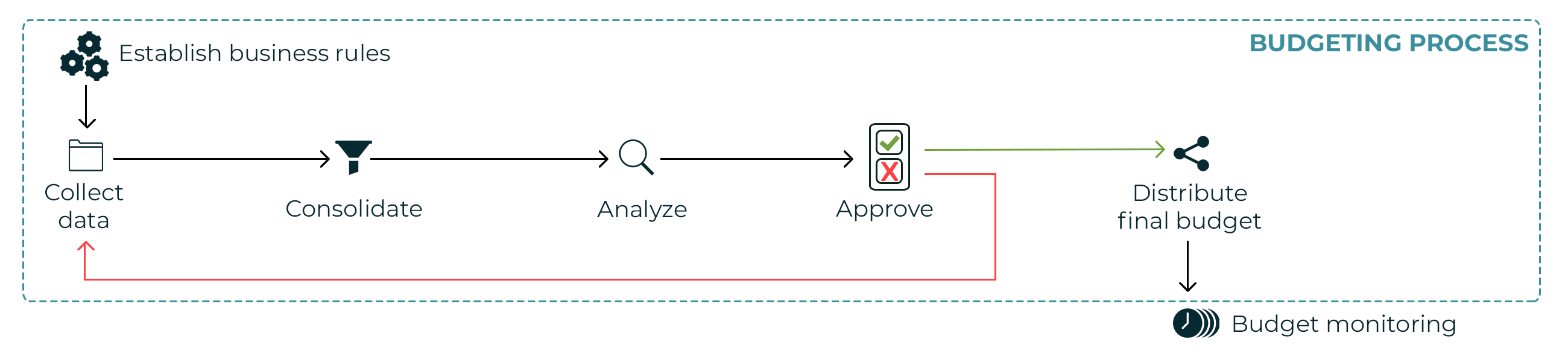

Let’s break down the budgeting process so we can see where the inefficiencies lie:

Steps in the budgeting process:

- Establish business rules:

- This is the stage when you set time lines for the budget process, tell the various contributors how to enter budget data, create and explain how the various data collection templates work, including the automatic calculation functions.

- Collect data:

- This is the stage when the various contributors enter their budget data. It starts when the data collection templates are sent out, and ends when the person in charge of the budgeting process receives the completed templates.

- Consolidate:

- This is the stage when the templates are consolidated to generate an overall budget for the entire organization.

- Analyze:

- This is when the Finance function analyzes the consolidated budget report to see whether or not it is aligned with the organization's requirements. For example, this is where we check if the expected profitability has been achieved (or, for public bodies and NPOs, if they have a balanced budget) and whether the various administrative units have respected their envelopes. We will also analyze whether the scenario complies with the financial ratios required by the creditors, an important aspect of budget credibility.

- Approve:

- This is when the organization’s decision-makers decide whether or not they will approve the budget. If they decide it is unsatisfactory, the organization will begin another iteration in order to finalize the budget, by either asking contributors for more data or by making centralized adjustments.

- Distribute final budget:

- Once the budget has been finalized, it is officially distributed to management to serve as a reference document for the upcoming year.

OPTIMIZE YOUR BUDGET PROCESS USING A SPECIALIZED BUDGETING TOOL

Everyone knows that coordinating the budget process is one of the Finance function’s most challenging projects. What other task within the organization involves so many complex, interconnecting steps? Finance has to: coordinate contacts with all managers; think about how to get out strategic and sensitive information organization-wide; provide all managers with the right tools; and represent senior management in a process that will influence the organization’s direction for an entire year. To add to the pressure, this exercise often has a direct impact on managers’ performance bonuses.

In order to rise to the challenge, Finance has got into the habit of holding the process at arm’s length by relying heavily on Excel. However, this approach is somewhat self-defeating, and the tendency to rely on Excel inevitably means a great deal of time is spent on non-value-added transactional and data processing activities.

Let’s take another look at the steps in the budgeting process and see where those non-value-added activities lie. Then, we’ll see how using a specialized budgeting tool can benefit not just the Finance function, but the organization as a whole.

- Establish business rules:

- The simple act of asking Finance to program and maintain an Excel template every year constitutes a significant inefficiency. If we want to transform the Finance function and have it focus more on analysis and less on transactions, then we should automate this useless, repetitive step by acquiring a tool that can reuse the data collection templates year after year, with no reconfiguration required.

- When choosing the best way to approach managers about this task, we must bear in mind that not everyone is at ease with numbers or is comfortable with the often complex calculations required to produce a budget. So, the details of payroll and Bill of materials (BOM) calculations, for instance, must run in the background of the data collection templates, so managers need not concern themselves with these parameters, and all they see is the end result. Budgeting tools can automatically produce modules for forecasting and managing payroll, calculating production in relation to sales, and revenue from products and services.

- Because so many people contribute to budget data, creating a single portal for all budget documents, including templates and management reports, means Finance will spend less time helping managers find the right document. Similarly, a password management policy that includes single sign-on (SSO) or password synchronization across workstations would prevent Finance from having to manage contributor passwords.

- Collect data:

- When several managers are involved in a decentralized budgeting process, collecting data is often the most energy-intensive step. This means it is crucial to optimize the input steps and procedures so the process is as short and straightforward as possible.

- At this stage, the traditional Excel process involves Finance providing support and training to managers; once the templates are sent out, Finance no longer has any control over them.

- However, with specialized budgeting tools, the managers involved in the budget process can fill out the data collection templates online and these templates are fed into the budget database in real time. Having a database that populates in real time creates new opportunities, such as the ability to review managers’ input for errors or instances where managers request budgets that significantly exceed their allocation. Finance plays a more active role during data entry, which means better iterations and fewer required to finalize the budget.

- At this stage, it is important that managers have the technical skills required to produce the budget they want. Using Excel means protecting the data collection templates so that, at the end of the iteration, you get a standardized result. This leaves managers little room to manoeuvre, as they try to express their budget vision using a file with limited input and descriptive abilities. For example, a manager might want to separate the amounts for professional services needed for recurring activities in their department from those needed for a new initiative they want to implement that year. If the template only allows the manager to enter a total amount, rather than breaking it down, the amount might be rejected due to lack of explanation or context. Specialized tools are based on industry best practices, and so have features that accommodate these scenarios. Intelligent templates include sophisticated data protection functionalities, giving them the flexibility to adapt to managers’ behaviour and input methods.

- Consolidate:

- Except for processes such as eliminating intercompany revenue, manual consolidation is a perfect example of a non-value-added data processing activity that could be completely cut from the budget process. There is no benefit to the organization from adding the totals of all the Excel files and obtaining a grand total. In fact, manually consolidating data actually has a negative impact as it extends the budget timeline, delays strategic decision making, disconnects managers from what should be a helpful budgeting tool and, finally, introduces significant risks of errors into the process.

- The specialized tool means data is entered into a real-time centralized database, so data consolidation becomes a thing of the past. Furthermore, being able to monitor real-time changes means the numbers can be analyzed during the data collection phase, as mentioned in the previous point.

- Analyze:

- Once the budget has been consolidated, Finance has to review it to check that the desired results have been achieved, approve the resulting financial ratios, identify potential savings and resolve any errors that may have occurred.

- Implementing a decentralized budget can potentially provide a great deal of highly relevant non-financial information that can be useful when performing a variety of tasks: justifying variances, responding to budget requests for new initiatives, identifying discretionary spending, and attaching contracts or complex analytical files related to requests. This information is usually not available in Excel because collecting it would be too complex, but not having it is a significant lost opportunity for Finance, which bears the final responsibility for analyzing and understanding the budget scenario in front of them, and also for identifying potential savings.

- When creating a budget in Excel, many recurring steps have to be manually redone. Because the data collection structure evolves over time, the shape of the consolidated database also evolves. These changes force Finance to start their analyses over again each year, and sometimes even at each budget iteration, which bogs the budget process down with non-value-added tasks.

- When consolidated with a specialized tool, most analyses can be produced by running a report that presents the ratios and results. For more in-depth analyses, such as finding potential savings, Finance can use the same tool to drill down and browse through their financial and qualitative data to find the information they need.

- Approve:

- If the current budget process allows for it, recording the decision-makers’ actions is a key part of an effective approval process. It is important to know who approved what, when and for how much. This helps Finance understand what budget movements occurred following approvals, and ensures the decision-makers involved are made accountable.

- It takes special expertise to ensure that certain resources are well budgeted and efficiently used. These types of expenditures should be approved by a centre of competence approach rather than by the usual hierarchical method. For example, if an organization has service points at several different locations, it should be up to the property manager to approve the maintenance budgets for all of them, as this person would have the expertise to identify possible cost-saving and streamlining opportunities.

- Specialized tools can handle these complex tasks, which can be difficult to do in Excel. These tools fully support organizational decision-making and accountability, and they eliminate time spent producing duplicate reports based on different budget approval processes.

- Distribute the final budget:

- While this step is often completely overlooked, it is crucial that managers receive the final version of their budget. Organizations that use Excel tend to ask managers to use the latest version of the data collection templates as their final budget, despite the fact that this format is not ideal for presenting information, and that centralized adjustments have often been made in the final stages that affect the managers’ budgets. Generating individual budgets in Excel and emailing them back to the different managers is a cumbersome, non-value-added task that risks inadvertently exposing confidential information.

- Organizations that use a specialized tool can view the final budget results in a report that can be used as a reference, management and decision-making tool throughout the year. What’s more, the report requires no effort on the part of Finance to either generate or maintain. The information can also be made more reader-friendly through summaries with links that allow decision-makers to drill down for more details where necessary.

CONCLUSION

Can technology solve the problems inherent to the budget process? The answer is obviously yes, but the next question is, which solution is the right one? There are so many different kinds, and so many kinds of solutions, all with different skills. Generally speaking, organizations have three choices: develop their own budgeting tool (because they believe they have very specific needs); use Excel (referenced throughout this article); or select a specialized budgeting tool based on industry best practices.

Before choosing a specialized budgeting solution, it’s crucial to get input from members of the Finance function, executives and managers and find out what they need. Remember that the primary purpose of most organizations is not to produce IT solutions, but to meet the needs of its clients. And that's where specialized solutions come in. They may require some investment, but if you compare them to the unknown costs of internal development, or consider the inefficiencies and risks involved in using Excel, the investment is definitely worthwhile.

Remember, budgeting is a highly strategic process undertaken to support senior management. Coordinating data from contributors across the entire organization is an extremely complex undertaking. The tools currently available use mature technology, are efficient, comply with industry standards and best practices, and have been designed to empower Finance, senior management, and managers to achieve their respective goals. In fact, the risk for your organization lies in not seriously considering using one.