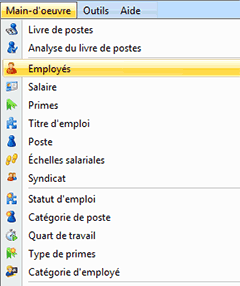

Features specific to the public sector.

Knowing that accountability issues are at the heart of the concerns of the public service, the Decimal Suite has been designed to offer a unique solution for all the financial processes of the public service.

Covering all the functionalities necessary for the finance functions of organizations, it also allows data consolidation, automation of report production, while offering flexible user security according to the highest standards

Discover the features specific to your needs

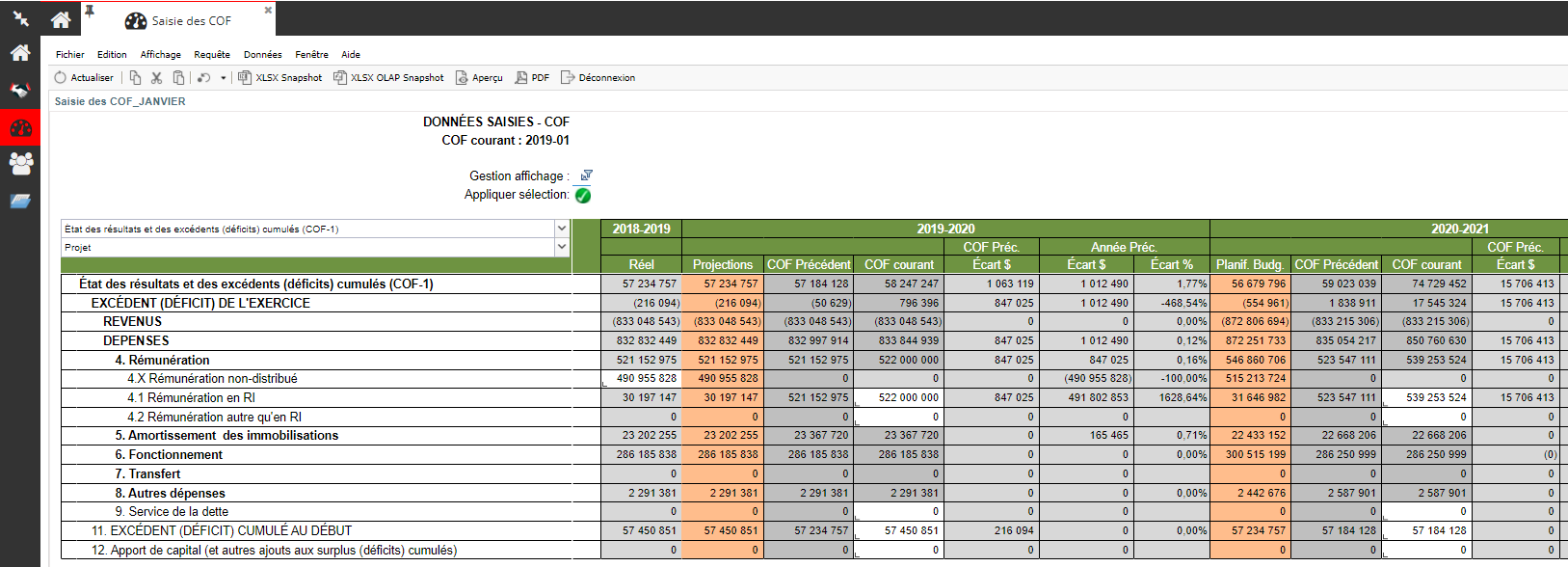

Consolidation and long-term planning

The Decimal Suite makes it easier for governments to consolidate and plan for the long term

The Decimal Suite has a number of tools that enable departments and agencies to seamlessly consolidate and plan for the long-term (COF), as well as enabling them to reuse the resulting information as benchmark data in their budget planning.

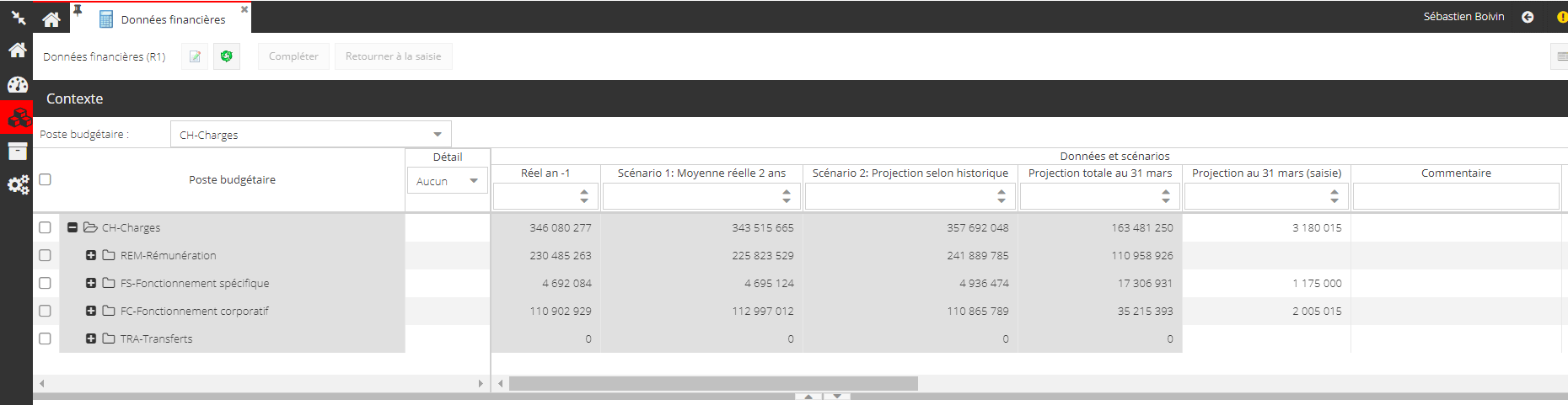

Users can employ the Subfolder Display feature to enter high-level budget items such as programs and components, and populate the account keys in the chart of accounts with allocation scenarios. This results in high-quality scenarios, and generates the necessary details for comparisons throughout the year.

Decimal Suite Brochure

Budget planning

Budget flow

The Decimal Suite's numerous features make it easy to share data, analyze results and budget complex items such as payroll. Read on to find out how the Decimal Suite supports budgeting.

The Decimal Suite's features to effectively manage your budgeting process are:

- Data is centralized in a single database, enabling simultaneous access by multiple users and eliminating consolidation;

- Automated consolidation of operating, payroll, capital and project budgets;

- All managers and authorized users can enter budget data directly and keep track of changes;

- Automated payroll and paid hours calculations;

- Customized templates can be set up without DECIMAL's involvement;

- Information from SAGIR or other financial systems can be reused as benchmark data in the collection templates;

- Set each user's unique security profile and access to information and processing;

- Create scenarios based on calculation rules at different levels: account, account type, or specific parameter;

- Establish budget expenses based on volumetrics;

- Organize data according to needs: chart of accounts, administrative units, etc.;

- Generate dynamic reports and include features that easily calculate variances, create multi-dimensional tables and drill down to detailed account forecast calculations;

- Can print reports, display them on screen or export them to other systems, including spreadsheets such as Microsoft® Office Excel;

- Has integrated text fields for entering notes and attaching files, to keep track of any relevant explanations;

- Keep track of organizational changes;

- If necessary, capture data at a more detailed level than the budget line item.

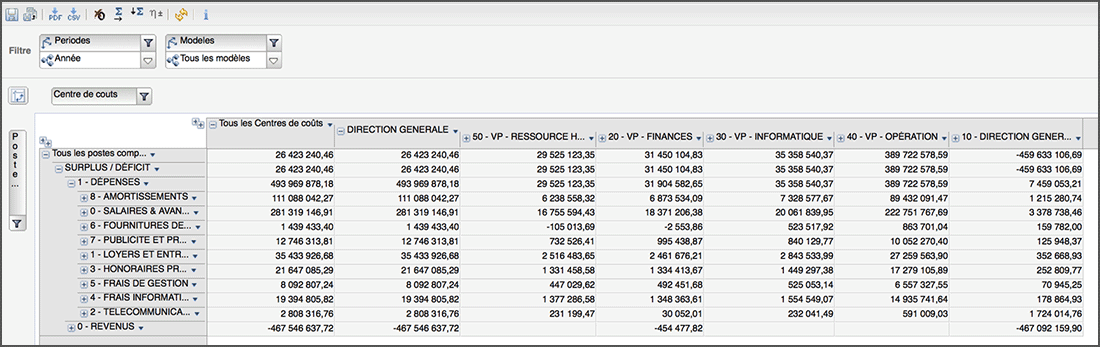

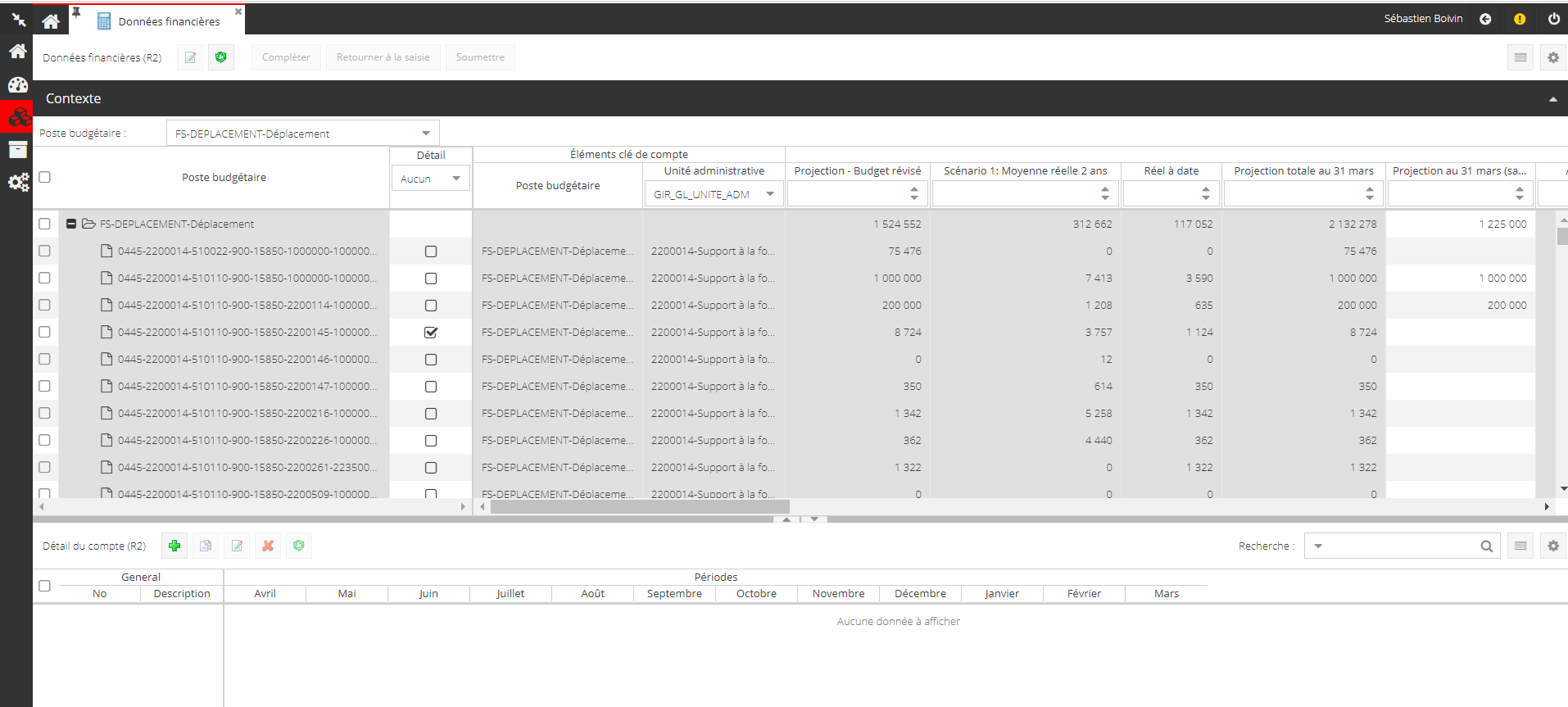

Data presentation

Managers can show multiple sets of data at the same time, as well as the variances between them. Information can be presented by expense type, by expense type classification (so it matches the structure of your financial statements), by cost centre and by hierarchical structure. They can decide whether or not they want to display certain columns and change the order in which they are displayed, thereby giving them access to the information they need in the format they want to complete their budget.

Monthly expense allocation

For each account, managers can budget their monthly expenses in one of three ways::

- Do their own monthly expense allocation;

- Enter their expenses annually and let the system allocate them based on the number of working days per month;;

- Use one or more expense allocation tables proposed by Finance. Users can create an unlimited number of allocation tables.

In this way, their expenses are systematically paid on a monthly basis.

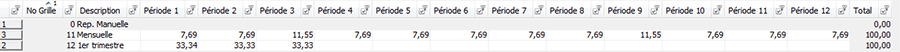

Example of distribution grids:

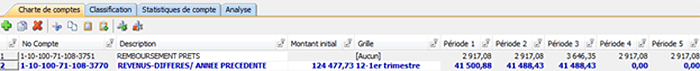

Application of the "1st quarter" grid to an account: the initial amount inserted by the manager is distributed over the months concerned according to the grid parameters.

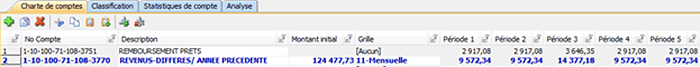

Change to the Monthly grid

Automated calculation

Some accounts combine a number of parameters with specific characteristics. For example, a benefits processing account applies several earnings codes to payroll. Applying the codes means these accounts can be automatically calculated, thereby reducing the need for user actions in response to changes in other accounts. These calculations can also be based on quantities and statistics, which can be built into the codes.

Decimal Suite Brochure

Monitoring and projections

Monitoring and projections

The Decimal Suite, for all your budget tracking needs!

With the Decimal Suite's different features, users can customize the budget tracking process based on their organization's specific needs, and stay aligned with industry best practices.

The features that help improve your budget tracking are:

- Custom web templates enable you to decentralize budget projection entry throughout the year, without DECIMAL's involvement;

- Information from existing financial systems can be reused as a reference to help collaborators with data entry;

- Explains variances in the reports, to decentralize the data collection process;

- Fully automated payroll, FTE and paid hours budgeting;

- Data is stored in a single centralized database, providing simultaneous access to multiple users and eliminating the need for consolidation;

- Automated consolidation of operating, payroll, capital and project budgets;

- Managers and authorized users can enter budget data directly and keep track of changes;

- Defines security profiles and user-specific information access and processing parameters;

- Creates scenarios based on calculation rules at different levels: account, account type, or specific parameter;

- Establishes budget expenses based on volumetrics;

- Organizes data according to needs: chart of accounts, administrative units, activities, programs, items, projects, etc.;;

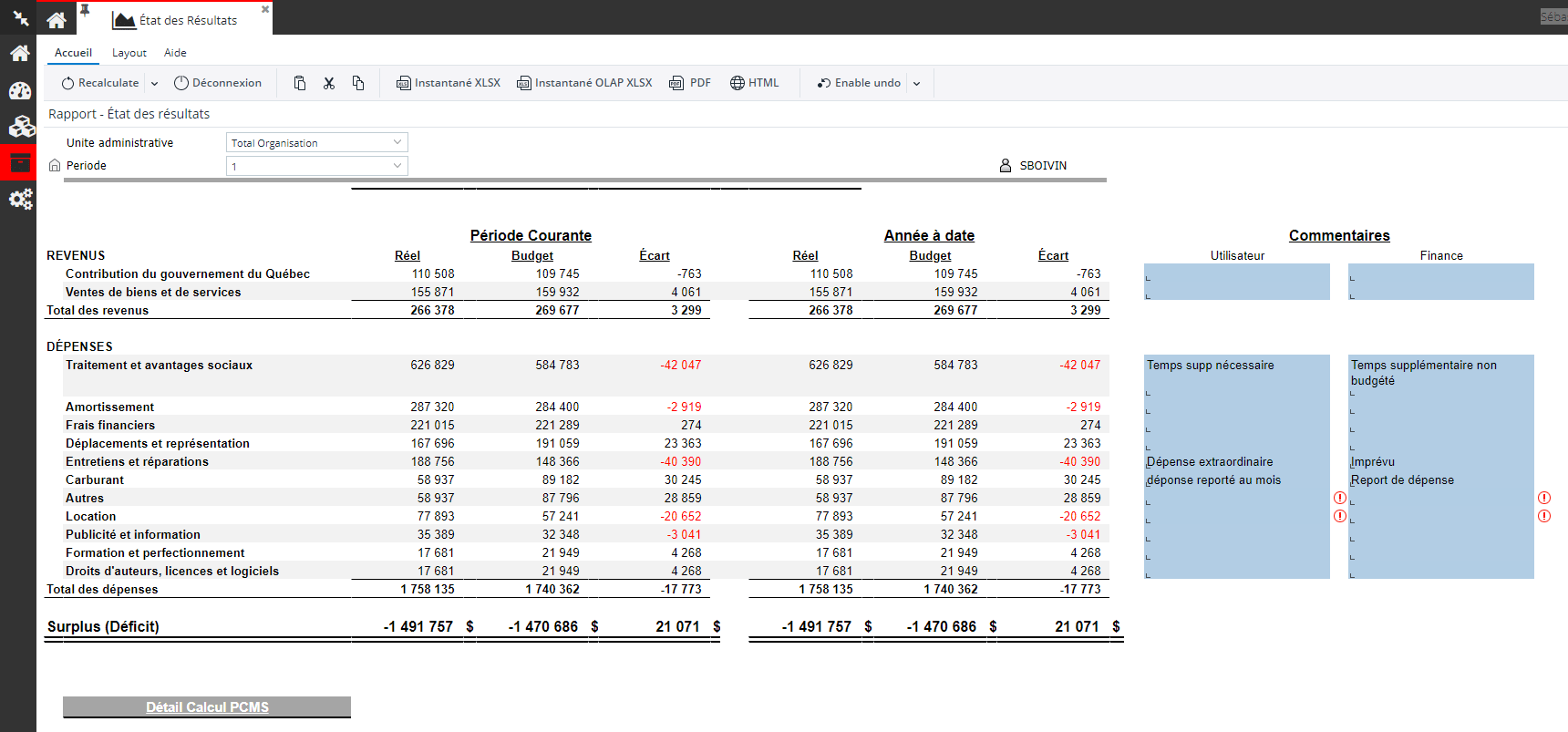

- Generate dynamic reports and include features that easily calculate variances, create multi-dimensional tables and drill down to detailed account forecast calculations;

- Prints reports, displays them on screen or exports them to other systems, including spreadsheets such as Microsoft® Office Excel;

- Keeps track of organizational changes;

- If necessary, captures data at a more detailed level than the budget line item.

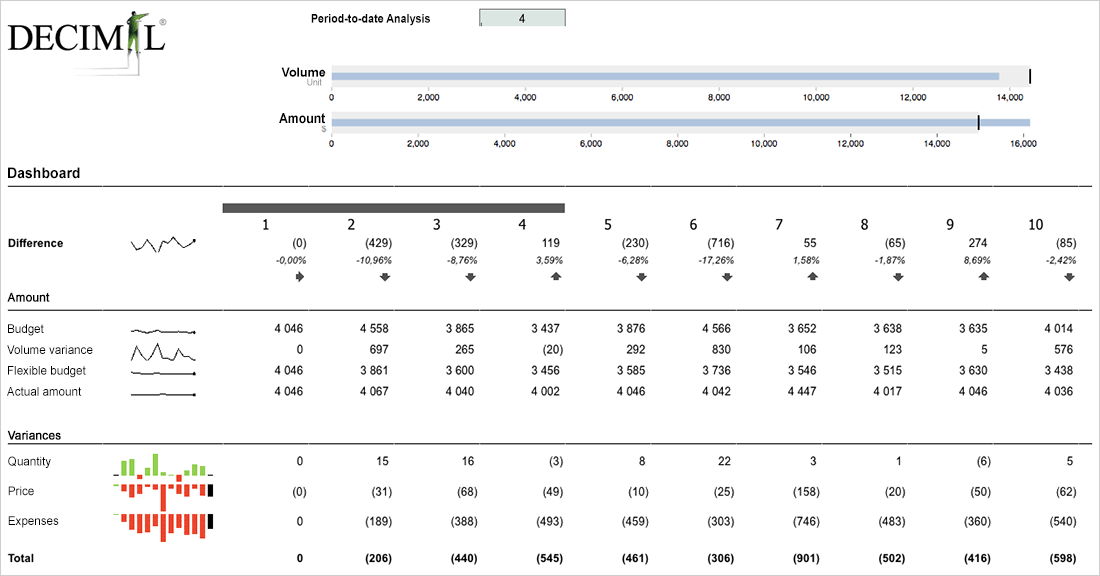

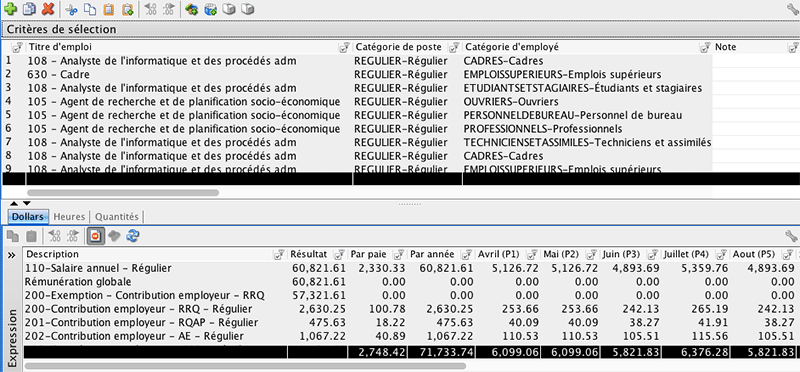

Sample data collection template:

Sample decentralized variance explanation template:

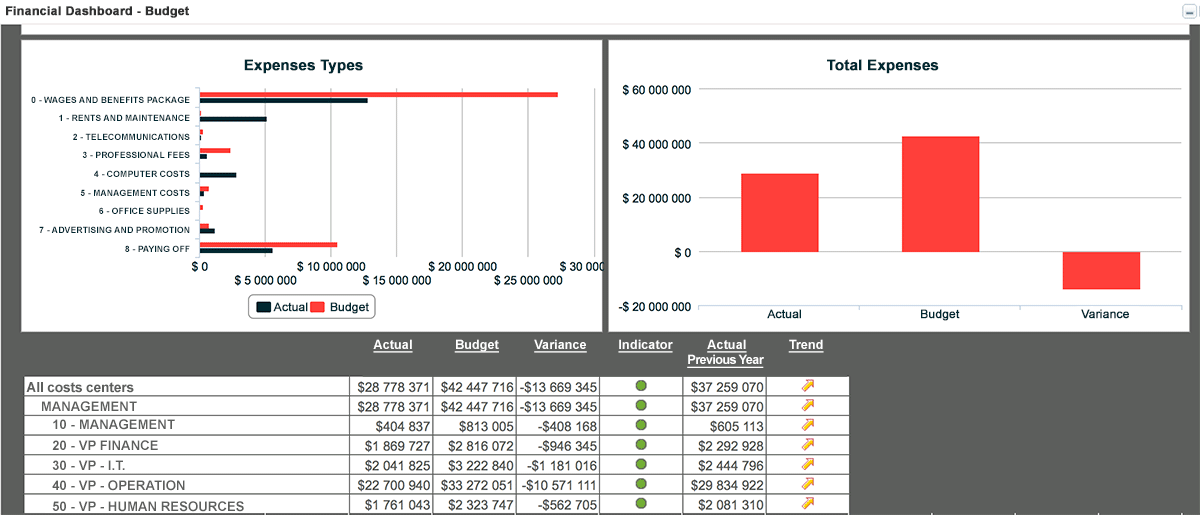

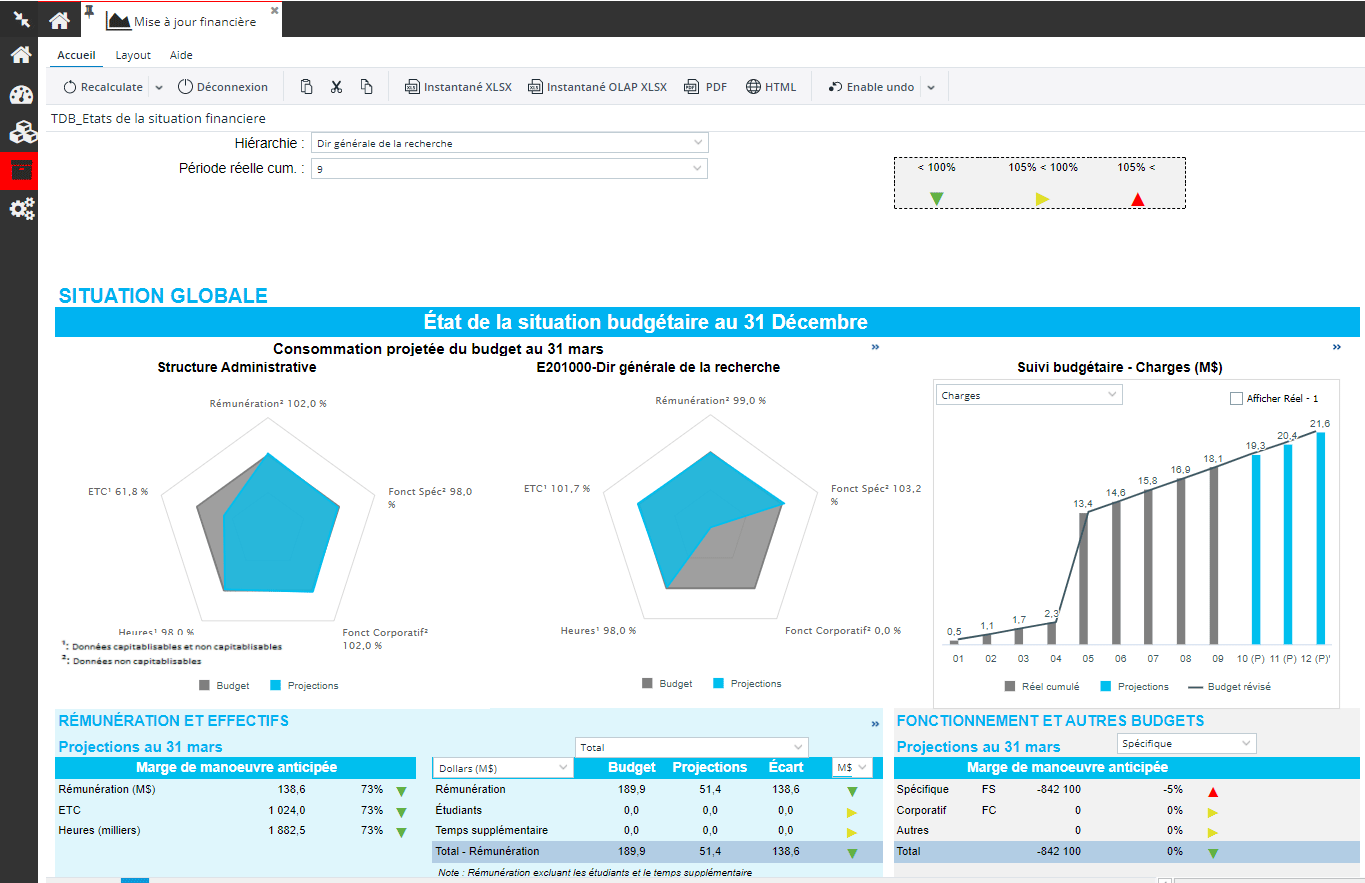

Sample dashboard:

Decimal Suite Brochure

FTEs and paid hours

FTEs and paid hours

A robust payroll planning and management solution

The ability to track FTEs and paid hours is finally a reality!

The Decimal Suite’s comprehensive payroll time tracking module allows users to customize it by entering whatever factors are needed, and accurately calculate each centre’s payroll and paid hours.

- Calculates all salary costs and keeps track of the type of expense: regular salary, overtime, social security contributions, bonuses, pension funds, union clauses or collective agreements, non-monetary remuneration and any other item that pertains to the organization.

- Can create an unlimited number of expense types and calculation rules.

- Easily creates scenarios and quickly presents results when assumptions are changed. .

- Because the calculation rules for paid hours are integrated into the calculation engine, payroll costs and paid hours are calculated simultaneously, so you only have one process to manage!

As a result, the tool can be used for budgeting, and also for forecasting the organization’s payroll costs and managers’ paid hours consumption. It’s also extremely helpful in negotiating collective agreements, as it can quickly and easily calculate the impact of possible changes on pay rates and working conditions.

Some of the tool's popular features:

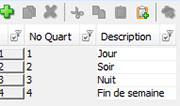

List of different shifts:

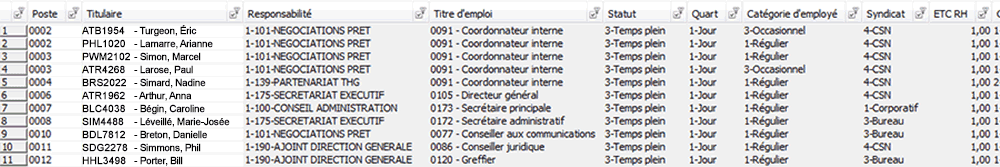

The payroll management tool enables users to structure all the elements that go into creating the position record . User-defined structures are associated with each position and include job status (full-time, half-time, occasional, etc.), job category, shift, and union.

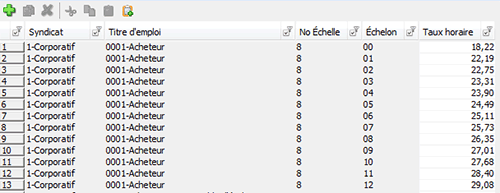

Echelons :

Next, they define the structures associated with each employee, such as employee category and employee salary.

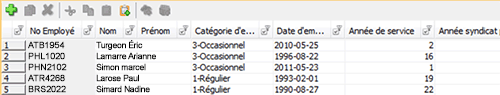

List of employees:

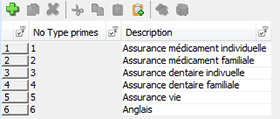

List of premiums:

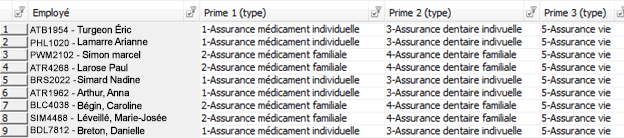

Connecting premiums to employees:

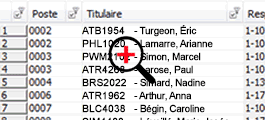

When the employee structure is combined with the position structure, the position record is created.

Then, you can apply the business rules to each of the defined structures, whether those structures are associated with positions or employees. For example, you could give a bonus to certain employees, such as those with full-time employment status.

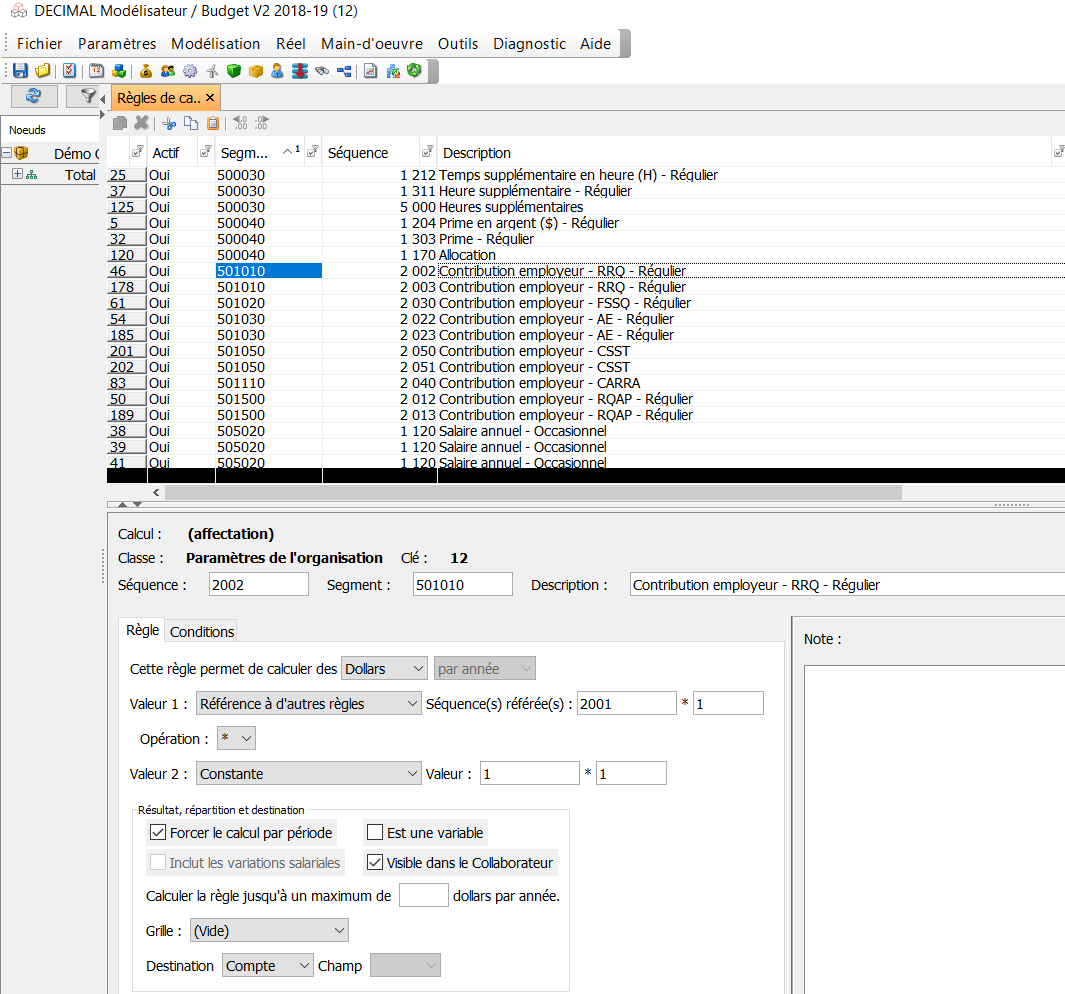

Business rules are powerful, highly flexible and able to overlap, i.e., the calculation result of one rule (or rules) can be input into another rule. They can calculate hours, quantities or dollars. For example, the tool can be used to accurately calculate the cost of benefits such as the QPP (Québec Pension Plan) per employee, which takes into account both the hourly rate and the number of hours worked.

Business rules are very flexible, powerful, and can be nested, i.e., they can accept as input the calculation result of one or more other business rules. The rules can calculate hours, quantities or dollars. This feature can be used to accurately calculate the per-employee costs of benefits such as QPP, which depend on both the hourly rate and the number of hours worked.

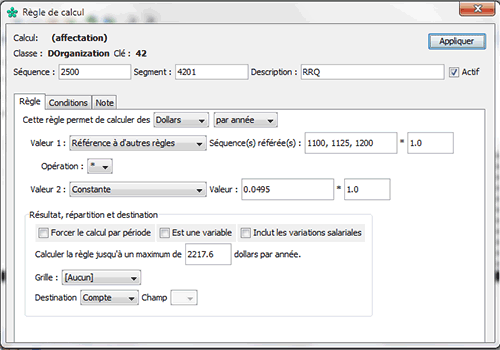

An example of a business rule for calculating QPP: the rule takes the total amount from three different rules (1100 - regular salary calculation, 1125 - overtime calculation, and 1200 - premium calculation), and multiplies the result by 4.95%, to a maximum total of $2,217.60 per year.

Hierarchy of business rules

The calculation engine processes the business rules that apply to position- or employee-associated structures in accordance with a very specific hierarchy: lower-level structures automatically inherit the business rules that are applied to higher-level structures.

For example, the organizational concept is at the top of the hierarchy, meaning a rule applied to the organization will apply to everyone. Employee benefit costs such as QPP usually apply to the organization. However, union data is applied further down the hierarchy. Only employees attached to a union will inherit the union-specific business rules. Finally, we have employees at the bottom of the hierarchy. This concept enables you to take into account employee birthdays, for example: the cost would be calculated for each employee and applied at the right time.

The payroll management module also calculates non-salary, employee-related costs. For example, you could budget $60 per month to cover the cost of managers' cell phones.

This brief overview should give you an idea of the tool's potential. You can use it to accurately and easily model your payroll costs, regardless of their complexity – we guarantee it!

Decimal Suite Brochure

PTI and project budgeting

PTI and project budgeting

Keep strict track of your project budgets!

The Decimal Suite's project budget planning and management module enables users to track the financial aspects of all their projects, and also meet their information resource management plan’s objectives.

The module is designed to seamlessly integrate with your organization's budgeting process, making it easier to plan, approve and track project costs. The tool gives you the ability to better document and justify your projects, so you can more easily balance budgets and keep costs under control.

The following Decimal Suite features help you manage your project budgets:

- Consolidates data in a centralized database providing access to multiple users at once;

- Project and operating budgets are fully integrated; it also manages capitalizable costs;

- Collects and centralizes qualitative project data, the kind usually recorded in Microsoft Word;

- All managers and authorized users can enter budget data directly and keep track of changes;

- Defines each user’s specific profile, security profile and access to information;

- Creates scenarios based on calculation rules at different levels: account, account type, or specific parameter;

- Establishes budget expenses based on volumetrics;

- Organizes data according to needs: chart of accounts, administrative units, etc.;

- Generates dynamic reports and includes features that easily calculate variances, creates multi-dimensional tables and drills down to detailed account forecast calculations;

- Reports can be viewed on-screen, printed or exported to other systems, including spreadsheet programs such as Microsoft® Office Excel;

- Has integrated text fields for entering notes and attaching files, to keep track of any relevant explanations;

- Keeps track of organizational changes;

- If necessary, captures data at a more detailed level than the budget line item.

Decimal Suite Brochure

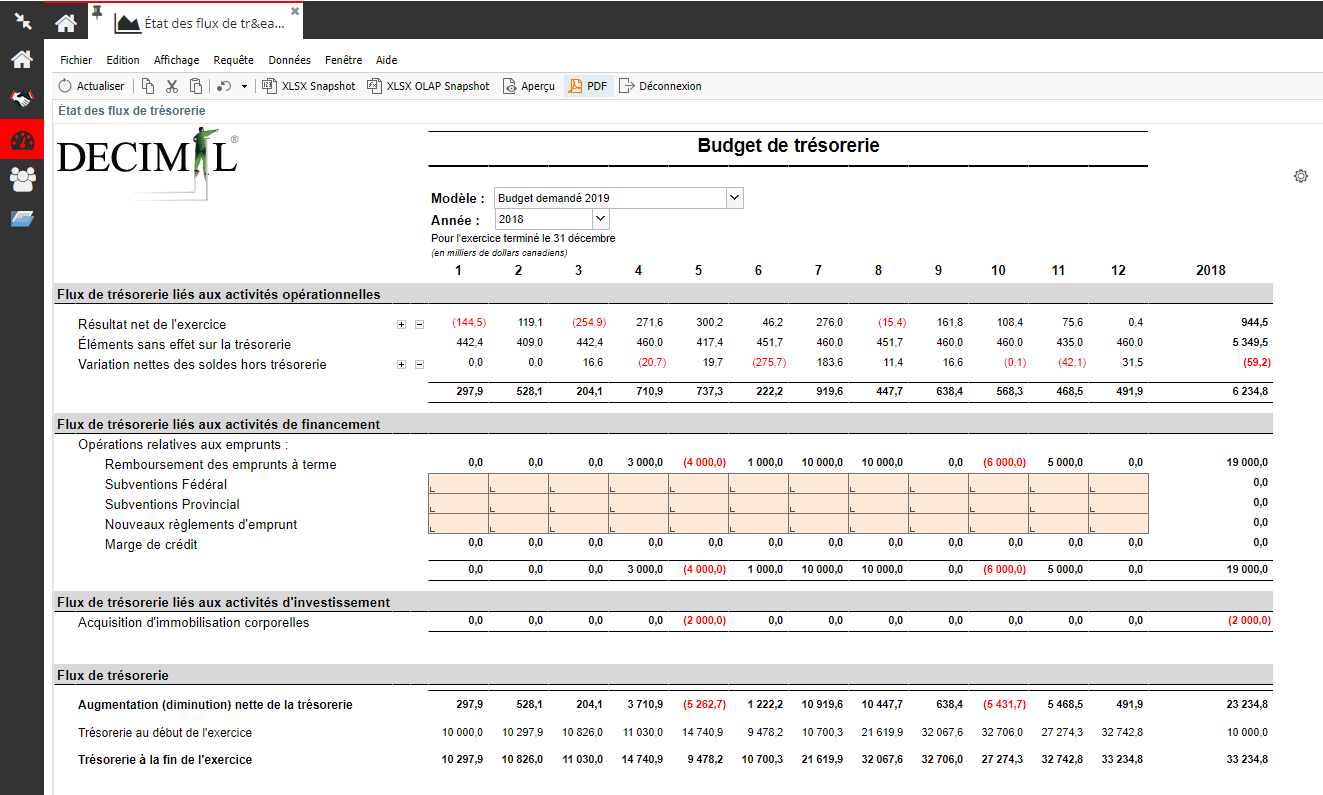

Cash flow budget

Cash flow budget

The Decimal Suite, the ultimate tool to track and map cash use

When you integrate balance sheet accounts and the changes in those accounts into the Decimal Suite, it becomes possible to track your organization's cash use. And, by inserting budget data into the Decimal Suite, you can project cash use based on different payment parameters, enabling you to zero in on periods that may require attention.

The Decimal Suite also enables you to run scenarios for different cash inflows and outflows. This means you can choose how your organization can best meet its cash flow objectives by, for example, increasing cash flow or decreasing interest costs.

Decimal Suite Brochure

Costing

Costing

Cost and price the full cost of products and services with the Decimal Suite!

Whether you need to know the cost of your products, services, business lines, sectors, programs, legislation, or any other item, the Decimal Suite is the right choice to handle these complex calculations and provide the necessary reporting transparency.

Because public entities are so complex, it's important for them to acquire tools that can keep track of the many accounts, activities and services and are able to calculate complete, justifiable, credible and accurate costs. Managing administrative restructuring, maintaining a comparable past history and handling changes in the organizations' products – all these call for a sophisticated methodology, expertise and software that will enable you to get the most out of your information.

The Decimal Suite enables users to perform the necessary calculations, organize their data and make it available to managers as a decision-making aid and for reporting purposes. The solution gives you full traceability of all costs, meaning organizations can find out where the costs allocated to a given sector come from, and also identify where a specific account has been allocated.

The Decimal Suite is an easy-to-use financial solution that managers can use to import data from the general ledger, perform calculations and generate the desired results.

Financial managers need no assistance to use the software, it requires no programming, and they can easily configure and modify allocations at any time. The Decimal Suite: the most powerful, complete and user-friendly costing tool available today.

Decimal Suite Brochure

Program allocations and costs

Program allocations and costs

Whether you want to distribute costs to business lines, sectors, programs, or any another group, the Decimal Suite is the right tool for the job.

Organizations wanting to track their costs in different accounting segments often struggle to with assigning each dollar to the right account. Allocating their costs puts this information at their fingertips.

The Decimal Suite enables users to allocate costs and decide which data to enter into their accounting system. This means they can allocate costs more accurately, based directly on results.

The Decimal Suite’s powerful software makes accurate cost allocation a snap. Its searchable database means organizations can find out where sector-allocated costs come from, and also where a specific account has been allocated.

The Decimal Suite is an easy-to-use tool that financial managers can use to import data from the general ledger They can also use it to perform calculations and generate entries that will automatically import into their accounting software - through Oracle Web ADI, for instance.

Financial analysts require no assistance to use the tool, it needs no programming, and they can easily configure and modify allocations at any time. The Decimal Suite: the most powerful, complete and user-friendly allocation tool available today.

Decimal Suite Brochure

Analysis

Analysis

Get the information you need, now!

The Decimal Suite has an integrated data analysis tool that can be used any time to query your data. It can:

- Generate on-demand management information;

- Create complex reports and analyses;

- Validate information imported from other systems;

- Search for specific information;

- Perform dynamic analysis for improved understanding of costs, budget data and paid hours consumption.

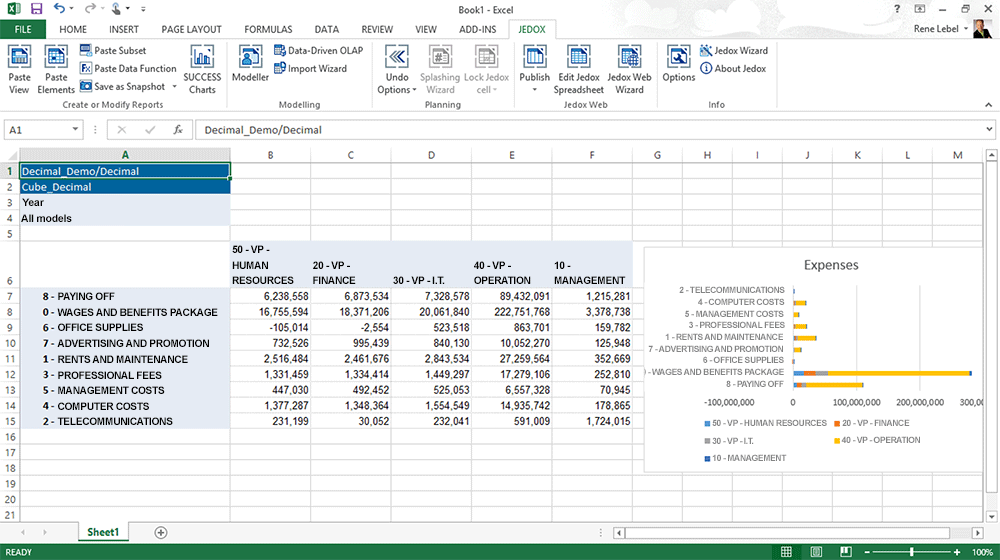

Whether you want to perform ad hoc queries, build a pivot table, or create an analysis table, you can build your own reports, save them, and save the report templates for future use. You can also share these templates with your co-workers, who can use them to analyze data from their own responsibility centres.

Decimal Suite Brochure

Financial reports, analysis and dashboards

Financial reports, analysis and dashboards

Dashboards are a performance management tool that’s fully aligned with your organization’s strategy

Although the Decimal Suite focuses primarily on financials, it can track multiple indicators in a wide range of business areas.

Our dashboards display a range of indicators that enable managers to:

- Track results;

- Track deviations from benchmarks, such as set objectives, internal or external norms, statistical benchmarks, more or less in real time, focusing on the most significant deviations.s

Indicators and strategies can vary widely from one organization, and even one department to another. It’s the same for dashboards. Typically, organizations base their indicators on whatever tools they use to take corrective action, i.e., on future decisions to be made. Our dashboards translate the organization's strategy into user-friendly, measurable and relevant performance indicators.

We recommend you choose your dashboard performance indicators with care, to ensure your organization’s objectives are aligned with its performance management.

DECIMAL experts can help you set your organization's KPIs. Then, the Decimal Suite enables you to share this information throughout your organization, via the Intranet or Internet, using a computer or our tablet- or smartphone-enabled website.

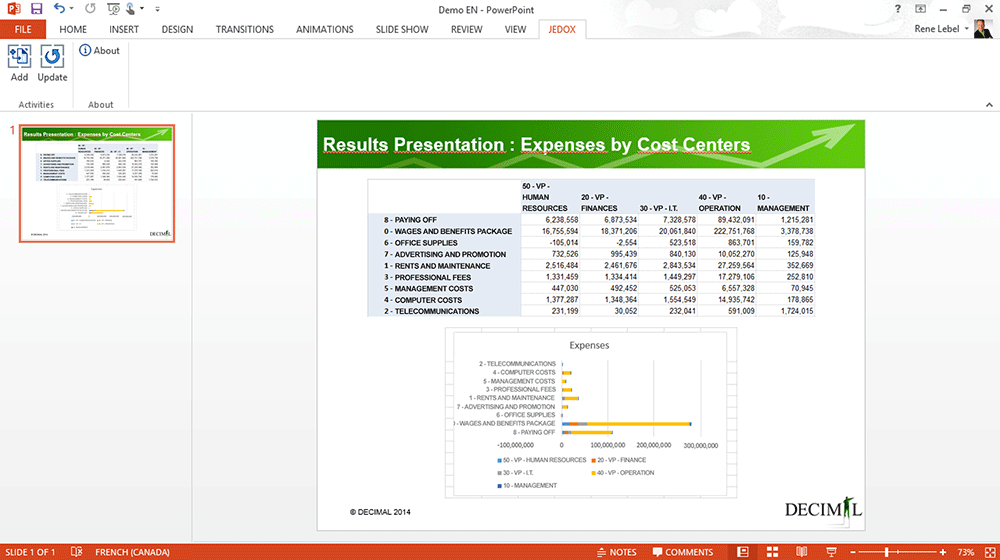

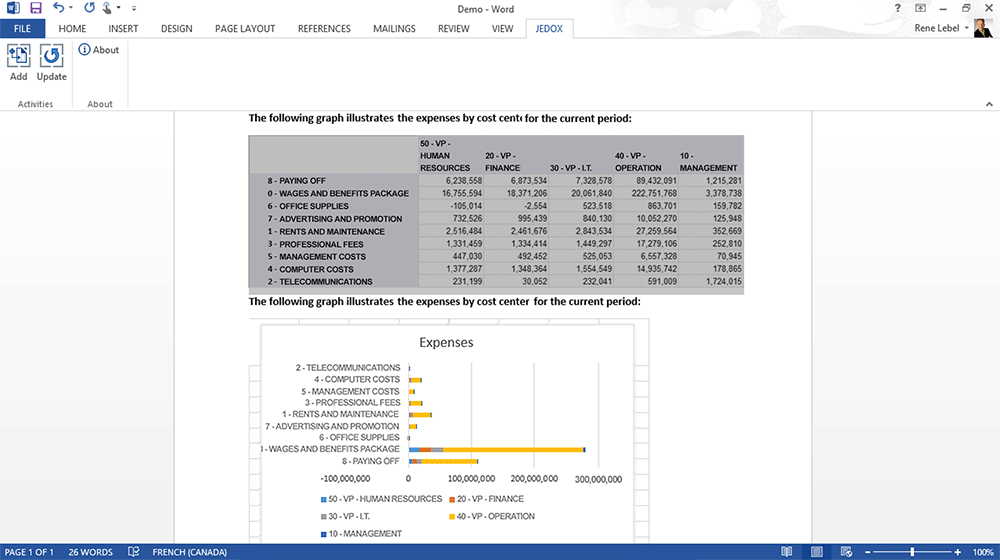

Financial reports

Have to produce ongoing monthly reports and presentations for your organization’s management committee? The Decimal Suite is the perfect tool for the job!

You can use it to:

- Access all your reports from a single database;

- Program, schedule and generate reports at a moment’s notice.

Our seamless integration with the MS Office Suite makes preparing reports and presentations a snap, and producing them an easy, one-step process.

Decimal Suite Brochure

ETL and admin

ETL and admin

Seamless integration with your organization's other systems

You probably use several different tools: financial systems, payroll and HR systems, in-house systems, etc. The Decimal Suite can easily interface with these different systems and exchange information with them.

The Suite’s import-export module enables you to share your existing information with other systems that can leverage it to your advantage. Using simple and extremely secure protocols, the Decimal Suite imports the data needed to consolidate all your management information in one place. If necessary, the Suite can also transfer some data back to your existing systems.

The Decimal Suite is built on an open database, enabling you to leverage data from a standardized data catalog . Simply connect your report or dashboard generator to the Decimal Suite data catalog, and continue using the internal report generator you’re familiar with; no need for additional staff training!

DECIMAL experts will even help you configure your own tools so they integrate more seamlessly with the Suite.

The Suite's features also make it possible for you to export data in different formats, depending on your needs. To keep your data secure, the Administrator module includes a data access monitoring tool that lets you know when data has been retrieved from the application.

Decimal Suite Brochure